[ad_1]

Prices of paying down debt climbed to report whereas internet value declined

Article content material

Canadians proceed to be hit by the climb in Bank of Canada interest rates, with the prices of paying down debt rising to a report within the third quarter whereas internet value declined, in response to Statistics Canada family finance knowledge launched Dec. 13.

Listed below are 5 charts that present how increased rates of interest have impacted Canadians, together with economists’ response to the information:

Commercial 2

Article content material

Article content material

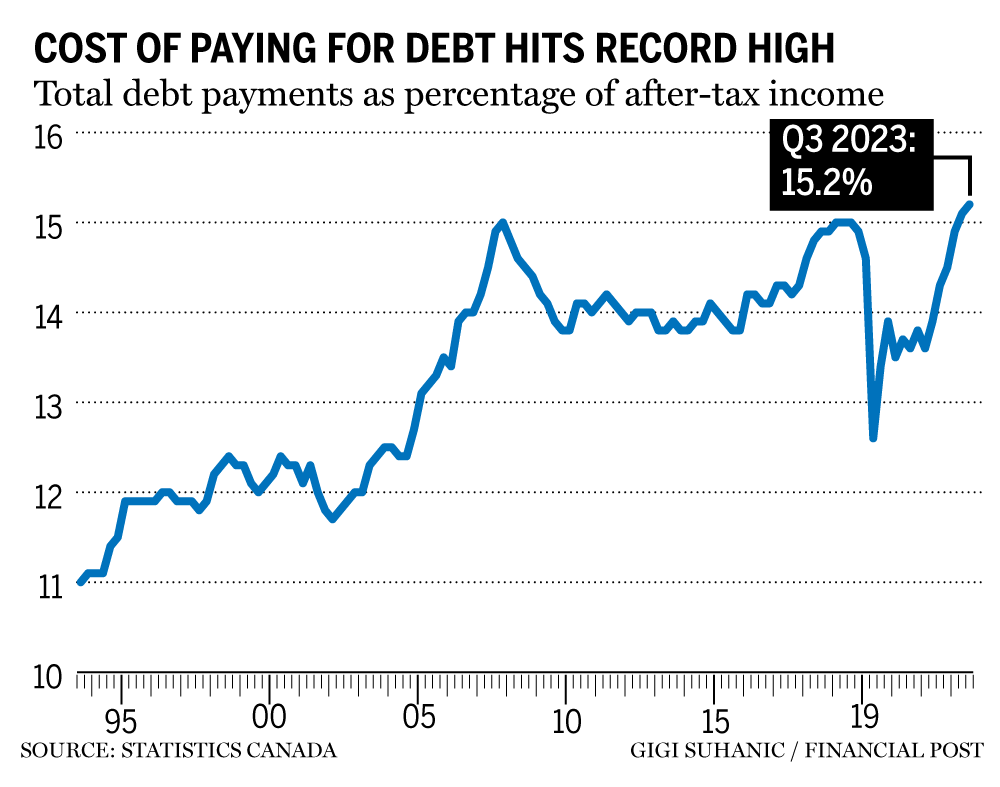

Debt prices rise

The quantity Canadians are paying to cowl the prices of debt rose to a report within the third quarter of 2023, with the family debt service ratio growing to fifteen.2 per cent from 15.1 per cent in Q2, Statistics Canada mentioned.

A lot of the enhance might be attributed to a report rise in curiosity funds over the previous six quarters, up from 5.9 per cent of disposable revenue to 9.3 per cent, which quantities to the best stage since 1995, mentioned economist Daren King at Nationwide Financial institution of Canada.

Borrowing prices might go increased nonetheless as many owners are set to resume their mortgages over the following two years, King mentioned. “Which means that the curiosity fee shock shouldn’t be over and represents a headwind for the financial system over the approaching 12 months,” he mentioned.

His view is backed by Royal Financial institution of Canada economists, who additionally predict continued rising prices “with a wave of mortgage renewals nonetheless to return.”

These increased prices will proceed to stress shopper spending, mentioned Shelly Kaushik, an economist with Financial institution of Montreal, in a notice to purchasers.

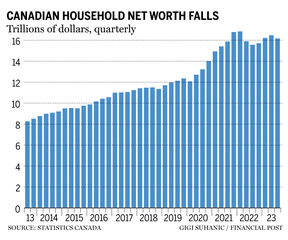

Family internet value declines

Family internet value fell by $301.2 billion to $16.2 trillion, down from $16.3 trillion within the second quarter, Statistics Canada mentioned.

Article content material

Commercial 3

Article content material

“The monetary climate turned stormy within the third quarter as each monetary and non-financial asset values declined, dragging down whole family wealth,” mentioned Maria Solovieva, an economist with Toronto-Dominion Financial institution.

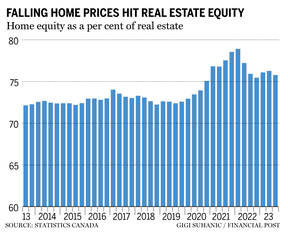

Actual property fairness drops

Canadians’ fairness in actual property fell by 1.7 per cent within the third quarter as dwelling costs dropped, mentioned Statistics Canada.

Dwelling fairness is now greater than 10 per cent under what it was when dwelling costs peaked within the second quarter of 2022, mentioned RBC economist Carrie Freestone. Nonetheless, it’s 57 per cent increased than within the fourth quarter of 2019, simply earlier than the beginning of the pandemic.

Fairness might fall additional with Canadian dwelling costs on observe to say no greater than three per cent within the fourth quarter, mentioned TD’s Solovieva.

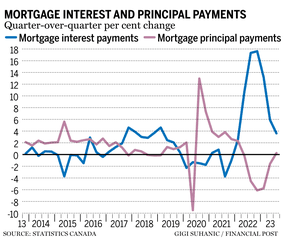

Mortgage curiosity will increase gradual

Because the Financial institution of Canada began mountain climbing rates of interest Canadians are paying extra curiosity on their mortgages with much less going towards the principal. However the enhance in curiosity funds slowed to three.6 per cent within the third quarter in contrast with 5.9 per cent within the second quarter, whereas principal funds elevated by 0.2 per cent after falling for 5 consecutive quarters, Statistics Canada mentioned.

Commercial 4

Article content material

The shift comes from owners negotiating longer amortization durations to “preserve their funds (curiosity and principal mixed) from growing too drastically,” Charles St-Arnaud, chief economist at Alberta Central, mentioned. “Nonetheless, this comes on the expense that households will stay indebted for longer.”

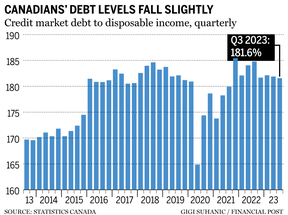

Debt ranges fall

Revenue outpaced progress in debt, resulting in a decline within the debt-to-income ratio, which now sits at 181.6 per cent in comparison with an upwardly revised 181.9 per cent within the prior quarter. Which means for each greenback of family disposable revenue within the third quarter, there was $1.82 in debt, mentioned Statistics Canada.

Increased borrowing prices are anticipated to proceed to be a “damper on mortgage demand, which ought to result in continued modest enchancment within the debt-to-income ratio,” Kaushik at BMO mentioned.

If revenue had not grown by one per cent within the quarter, St-Arnaud estimates the debt-to-income ratio would have risen to 220.9 per cent.

Associated Tales

• E-mail: gmvsuhanic@postmedia.com

Bookmark our web site and help our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material

[ad_2]

Source link