[ad_1]

Need extra tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the free, day by day ResiClub newsletter.

Financial forecasting has by no means been a simple process, and it turns into much more difficult when confronted with unprecedented financial occasions like COVID-19 lockdowns and unparalleled ranges of presidency intervention, adopted by a fast cycle of rate of interest hikes.

Look no additional than latest mortgage price forecasts. Final yr marked the second yr in a row, mortgage price forecasters at giant have missed—large time. That raises the query: Can we belief mortgage price predictions in any respect proper now?

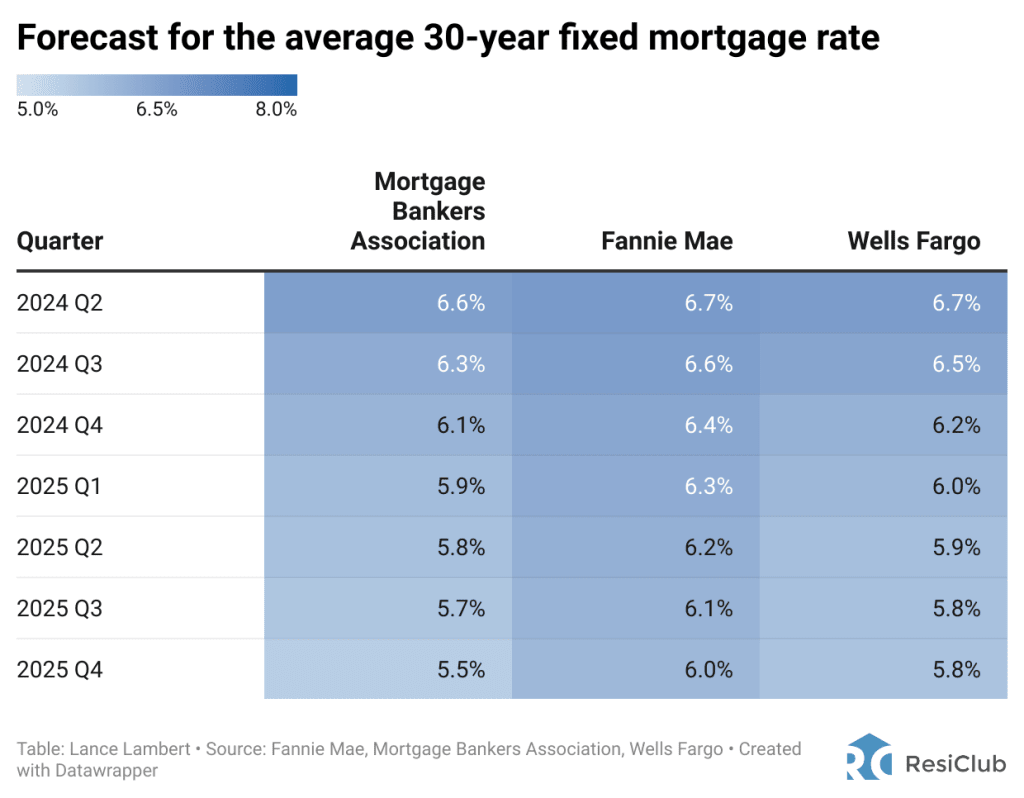

ResiClub’s newest roundup of quarterly mortgage price forecasts exhibits that the majority forecasters nonetheless anticipate mortgage charges to progressively lower over the subsequent 18 months. One purpose is that because the Federal Reserve presumably begins to cut rates, the bond market is predicted to turn out to be much less risky, resulting in a slight decline in mortgage charges.

The typical 30-year fastened mortgage price as of Thursday was 6.99%. By the ultimate quarter of 2025, Fannie Mae expects that to slip to six.0%. In the meantime, Wells Fargo’s mannequin expects 5.8%, and the Mortgage Bankers Association estimates 5.5%.

ResiClub takes all forecasts with a grain of salt. But when these forecasts come to fruition, it might imply that housing affordability would nonetheless stay strained in 2024 and 2025.

‘The housing market is more likely to proceed to face the twin affordability constraints of excessive dwelling costs and elevated rates of interest in 2024,” wrote Doug Duncan, chief economist of Fannie Mae, in March. “Hotter-than-expected inflation knowledge and robust payroll numbers are more likely to apply extra upward stress to mortgage charges this yr than we’d beforehand forecast, as markets proceed to evolve their expectations of future financial coverage. Nonetheless, whereas we don’t anticipate a dramatic surge within the provide of houses on the market, we do anticipate a rise within the stage of market transactions relative to 2023—even when mortgage charges stay elevated.”

[ad_2]

Source link