[ad_1]

Calendar yr 2024 presents mounted earnings buyers with a new rate regime when it comes to absolute yield ranges, and from a financial coverage perspective.

In contrast to 2022 and 2023, when price hikes dominated the panorama, this yr is anticipated to convey a change in surroundings from the Federal Reserve, the place rate cuts are quickly to be the first theme.

Nevertheless, given the result of the January FOMC meeting and attendant Powell presser, the timing and magnitude for an easing in coverage remains to be unsure.

As well as, financial information, akin to the latest jobs report, has additionally challenged the cash and bond markets’ most optimistic expectations, creating an atmosphere for continued elevated volatility.

Whereas the potential for ongoing bond market volatility definitely presents challenges, we’re additionally discovering many fascinating alternatives for mounted earnings buyers.

For advisors looking for the pliability to capitalize on bond market alternatives and regulate exposures as circumstances change, Mannequin Portfolios can present cost-effective entry to the experience of our asset allocation and glued earnings groups.

Our WisdomTree Fixed Income Model Portfolio lately handed its 10-year anniversary since inception. To mark the event, we needed to offer an replace on our present outlook and positioning, and look again on efficiency since inception.

Positioning inside our Mounted Revenue Mannequin Portfolios

Under we summarize the present positioning and among the latest modifications inside our WisdomTree Mounted Revenue Mannequin Portfolio, which is dynamically managed based mostly on the top-down and sector-specific views of our Mannequin Portfolio Funding Committee.

WisdomTree Mannequin Portfolio Funding Committee—Mounted Revenue Positioning

Given the inverted nature of the yield curve, we stay allotted to short-duration bonds, together with Treasury floating rate notes.

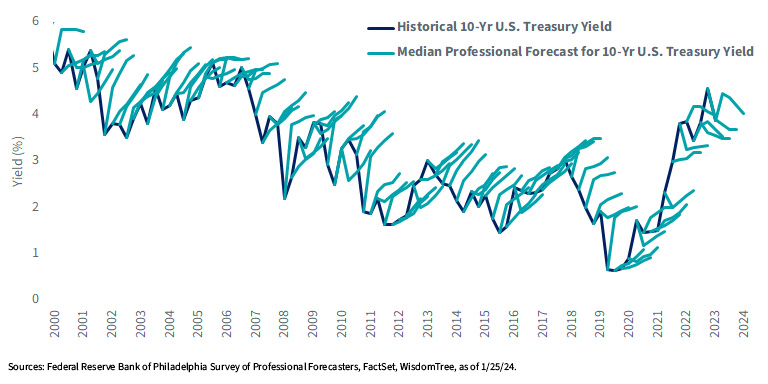

Nevertheless, utilizing a barbell approach, we continued so as to add length in a deliberate method in 2023. After spending a lot of the previous few years shorter in length than our benchmarks, we are actually nearer to a “impartial” stance, which we really feel is prudent given the extent of ongoing rate of interest volatility and the inherent problem in predicting shorter-term actions in rates of interest (see under).

10-Yr U.S. Treasury Yield: Historic vs. Median Skilled Forecast

One other alternative we see in mounted earnings markets is securitized belongings, particularly company mortgage-backed securities (MBS). Whereas investment-grade and high-yield company credit score spreads tightened nicely within their historic averages final yr, we consider yields on company MBS relative to Treasuries supply enticing worth. Subsequently, we rotated from high-yield corporates into MBS, whereas sustaining a modest over-weight allocation to high quality high-yield credit score.

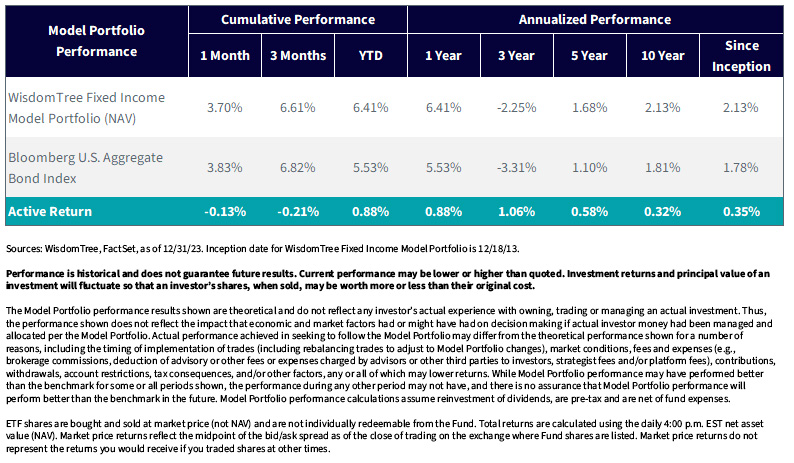

A ten-Yr Observe Document of Efficiency

Since its launch in December 2013, the WisdomTree Mounted Revenue Mannequin Portfolio has delivered on its goal, outperforming the Bloomberg U.S. Combination Bond Index since inception and over the previous 1-year, 3-year, 5-year and 10-year intervals.

Monetary advisors can study extra in regards to the WisdomTree lineup of mounted earnings and multi-asset Mannequin Portfolios by visiting our Model Adoption Center.

WisdomTree Mounted Revenue Mannequin Portfolio Efficiency

Necessary Dangers Associated to this Article

For retail buyers: WisdomTree’s Mannequin Portfolios should not supposed to represent funding recommendation or funding suggestions from WisdomTree. Your funding advisor might or might not implement WisdomTree’s Mannequin Portfolios in your account. The efficiency of your account might differ from the efficiency proven for a wide range of causes, together with however not restricted to: your funding advisor, and never WisdomTree, is answerable for implementing trades within the accounts; variations in market circumstances; client-imposed funding restrictions; the timing of shopper investments and withdrawals; charges payable; and/or different components. WisdomTree is just not answerable for figuring out the suitability or appropriateness of a technique based mostly on WisdomTree’s Mannequin Portfolios. WisdomTree doesn’t have funding discretion and doesn’t place commerce orders on your account. This materials has been created by WisdomTree, and the knowledge included herein has not been verified by your funding advisor and will differ from data offered by your funding advisor. WisdomTree doesn’t undertake to offer neutral funding recommendation or give recommendation in a fiduciary capability. Additional, WisdomTree receives income within the type of advisory charges for our exchange-traded Funds and administration charges for our collective funding trusts.

For monetary professionals: WisdomTree Mannequin Portfolio data is designed for use by monetary advisors solely as an academic useful resource, together with different potential assets advisors might think about, in offering providers to their finish purchasers. WisdomTree’s Mannequin Portfolios and associated content material are for data solely and should not supposed to offer, and shouldn’t be relied on for, tax, authorized, accounting, funding or monetary planning recommendation by WisdomTree, nor ought to any WisdomTree Mannequin Portfolio data be thought of or relied upon as funding recommendation or as a advice from WisdomTree, together with relating to the use or suitability of any WisdomTree Mannequin Portfolio, any explicit safety or any explicit technique.

[ad_2]

Source link