[ad_1]

The WisdomTree Global ex-U.S. Quality Dividend Growth Fund (DNL) seeks to trace the value and yield efficiency, earlier than charges and bills, of the WisdomTree Global ex-U.S. Quality Dividend Growth Index (WTGDXG).

The WisdomTree World ex-U.S. High quality Dividend Development Index selects firms from developed worldwide and emerging markets that rating properly throughout measures of profitability like return on equity (ROE) and return on assets (ROA), and earnings development prospects. The funding philosophy behind the Index is to focus on publicity to dividend rising firms outdoors the U.S. with high quality and development traits.

With the Index’s regional changes to its developed worldwide and rising markets allocations, this method gives a balanced publicity to the funding alternative set of worldwide ex-U.S. equities.

Common Annual Complete Returns as of 9/30/23

For the newest month-end and standardized efficiency, click on here.

For definitions of phrases within the desk above please go to the glossary.

WisdomTree carried out the annual reconstitution of WTGDXG in the course of the center of October. This publish gives a assessment of the Index reconstitution.

Nation and Sector

Given the macroeconomic backdrop, WTGDXG noticed a rise in its publicity to the Vitality and Supplies sectors. Vitality firms have skilled 18 months of strong revenue development on the again of upper oil costs and Canadian firms like Canadian Pure Sources Ltd and Whitecap Sources, Inc. have been added to the Index.

However, firms within the Client Staples sector will not be anticipated to proceed rising on the tempo they’ve proven previously few years. Due to this fact, names like Nestle S.A. and Unilever Plc have been dropped from the Index.

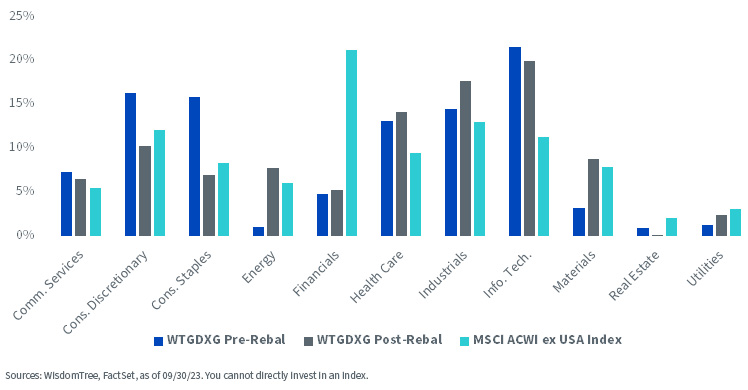

WTGDXG stays over-weight within the Well being Care and Info Expertise sectors relative to its benchmark, the MSCI ACWI ex-USA Index, and under-weight in Financials and Utilities.

Sector Exposures

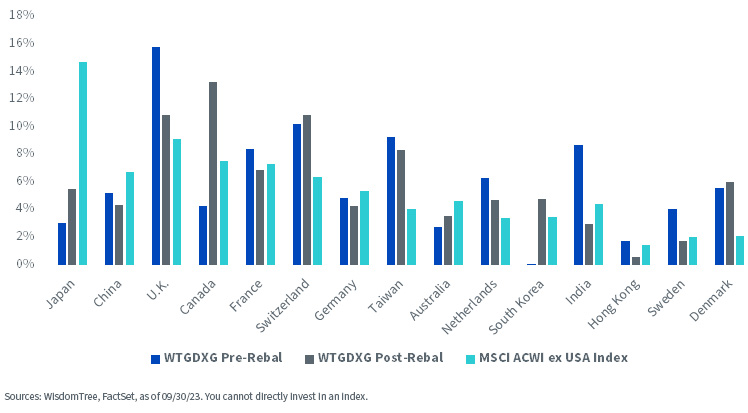

Japan, Canada and South Korea had notable will increase of their weights. Japanese Info Expertise firms like Tokyo Electron Ltd. and Murata Manufacturing, together with South Korean Samsung Electronics Co., are a couple of of the names answerable for this enhance. Exposures to the U.Ok. and India fell in the course of the newest rebalance.

WTGDXG stays over-weight in Switzerland and Taiwan relative to its benchmark, whereas being under-weight in China and Japan.

Nation Exposures

Fundamentals

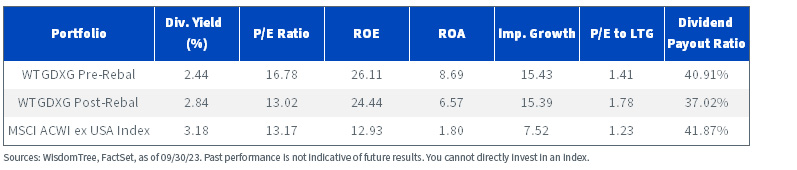

Submit-rebalance fundamentals should be analyzed within the context of the sector and nation modifications talked about above. The portfolio is being repositioned into firms whose development expectations are strong within the medium time period with sturdy steadiness sheets.

Submit-rebalance high quality metrics, ROE and ROA, proceed to be considerably greater than the MSCI ACWI ex-USA Index, whereas having a better implied development as measured by the earnings retention instances the ROE. WTGDXG’s decrease payout ratio post-rebalance additionally indicators how its constituents are reinvesting a better share of earnings in development alternatives and will have a extra sustainable dividend.

Inside its goals, WTGDXG’s fundamentals present a portfolio with extra engaging high quality and development metrics than the MSCI ACWI ex-USA Index. These benefits ought to make WTGDXG’s market-like P/E engaging for traders.

Regional Publicity

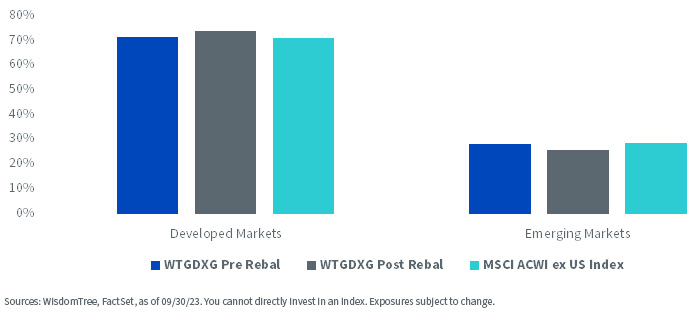

WTGDXG’s methodology features a regional adjustment issue utilized at rebalance such that the regional (growth markets and rising markets) weights are equal to the float-adjusted market capitalization weight of the beginning universe.

As we are able to see beneath, there might be a slight change to regional exposures at rebalance and the portfolio will stay barely over-weight in developed markets and under-weight in rising markets relative to its benchmark.

Regional Exposures

Essential Dangers Associated to this Article

There are dangers related to investing, together with potential lack of principal. International investing includes particular dangers, equivalent to threat of loss from foreign money fluctuation or political or financial uncertainty. Funds focusing their investments on sure sectors enhance their vulnerability to any single financial or regulatory growth. This will likely lead to better share value volatility. Dividends will not be assured, and an organization presently paying dividends might stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link